SAP BRIM Clarification Rules: Stop Wrong Invoices, Protect Revenue & Trust

SAP BRIM Clarification Rules: Stop Wrong Invoices, Protect Revenue & Trust

SAP BRIM – Clarification in Convergent Invoicing

Problem Statement

At times, invoices generated through Convergent Invoicing (CI) in SAP contain unexpected or abnormal amounts. These invoices may be automatically posted, printed, and sent to customers before any validation can occur. When customers receive such invoices and raise concerns about the irregular charges, SAP users must then manually intervene—by cancelling the invoice, reissuing it, or generating a credit or debit note to correct the discrepancy.

Due to the large volume of data processed during batch jobs, identifying such anomalies in real-time is not feasible, which can result in a poor customer experience.

Example Scenario

Consider our client, Netflix. It issues monthly invoices to its subscribers based on their selected plans. Suppose, due to an unhandled system error, an invoice is generated with an abnormally high amount and sent to a regular customer. This could lead to customer dissatisfaction, possibly causing the customer to cancel their Netflix subscription and switch to a competitor like Amazon Prime or Disney+.

Solution

- SAP BRIM offers a standard feature known as Clarification Rules to help mitigate such issues. With this functionality, clients can define acceptable value ranges for invoices or billing documents. During invoice generation—whether through batch or individual processing—only documents falling within the predefined amount range are processed and posted.

- If any invoice exceeds or falls short of the defined range, it is automatically excluded from posting. Instead, a clarification case is created for that billing item. These exceptions can then be manually reviewed and resolved by authorised users.

- For Example: Netflix offers monthly subscription plans ranging from $6.99 to $22.99, including options like "Standard with Ads," "Standard," and "Premium." By defining a permissible range of $5 to $30 in the clarification rules, Netflix can ensure that only invoices within this threshold are automatically posted. Any invoice amount outside this range is flagged and isolated for manual review, thereby avoiding customer dissatisfaction caused by billing errors.

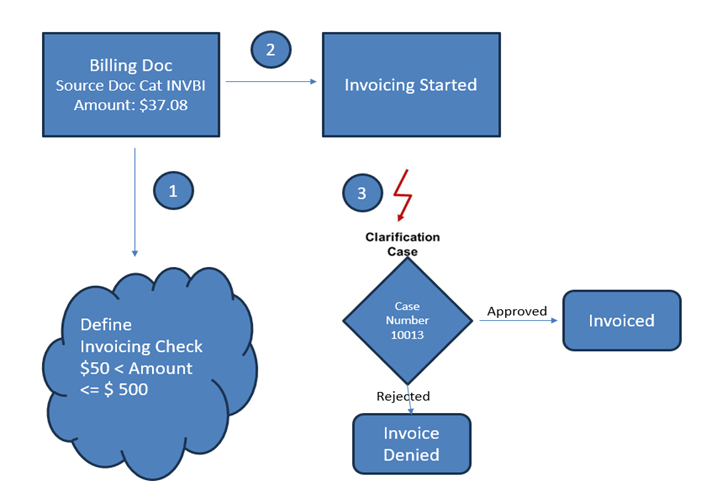

Process:

1. Define checks in the Bill (Source Document):

We can define a source document check based on amount or quantity.

Once the BITs are received, they will be billed, however the billing process will skip those items which don’t fall withing the plausible range and it will create a Clarification Case. These items will not be invoiced unless they are clarified from the clarification worklist.

2. Define checks in the Invoice:

The invoicing process is also interrupted if the validation fails, and clarification cases are created for those implausible line items.

3. Billing/ Invoicing: Run billing or invoicing with an implausible value (amount or quantity-based validation)

4. Manual clarification on the Clarification Cases:

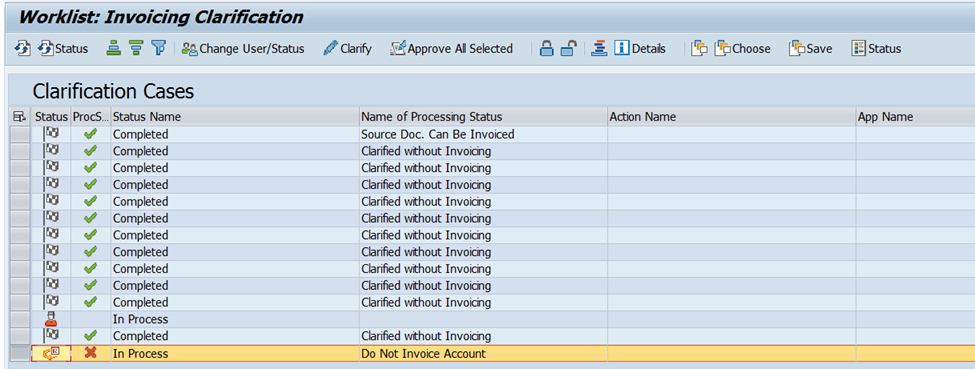

The Clarification Worklist is a tool to handle the skipped items. It supports the following functions:

- Check document

- Clarify, set validation on true

- Put clarification on hold

- Reject invoicing

- Run invoicing process manually

5. Process billing/ invoicing: If the items are approved from clarification, bill or invoices are generated with a clarification history. The rejected items are not processed further.

Pre-requisite:

To allow Clarification Case creation, the following Invoicing Functions need to be activated:

1. VALIDAT_SRC (for validating billing documents)

2. VALIDAT_INV (for validating invoices)

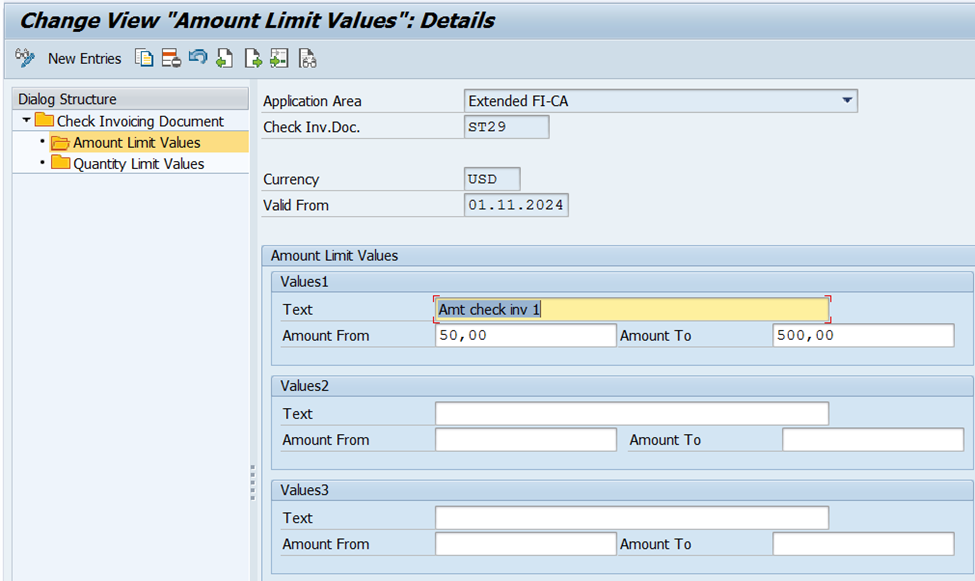

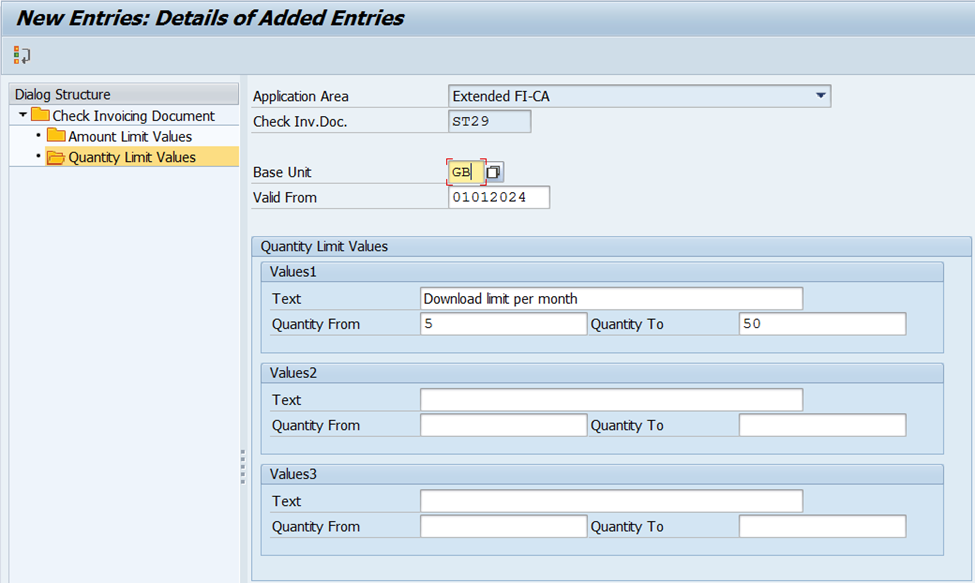

3. Set plausible values for Billing and/ or Invoicing:

Amount based validation:

Usage/ Quantity based validation:

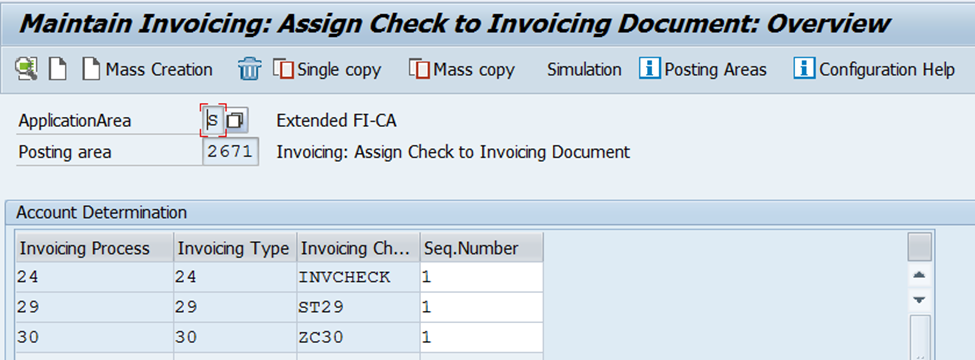

4. Map the Check rules against Invoicing Process and Invoicing Type:

Outcome:

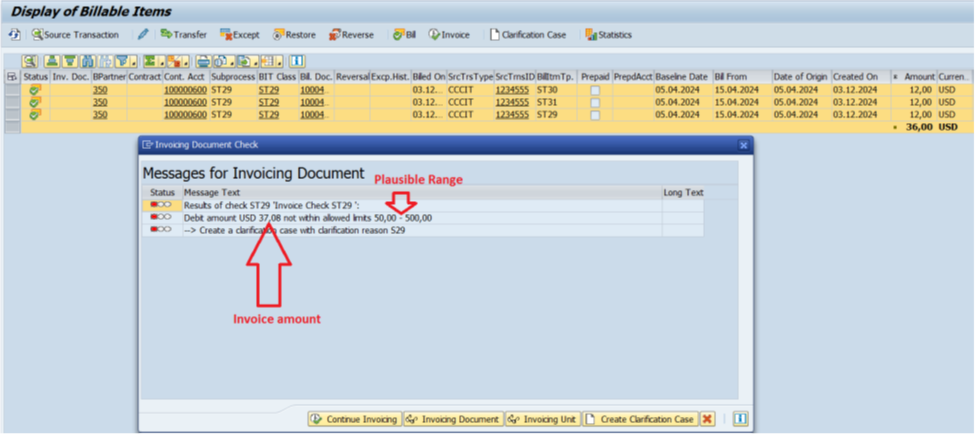

1. Invoicing with less than $50. Clarification Case creation pop up appears

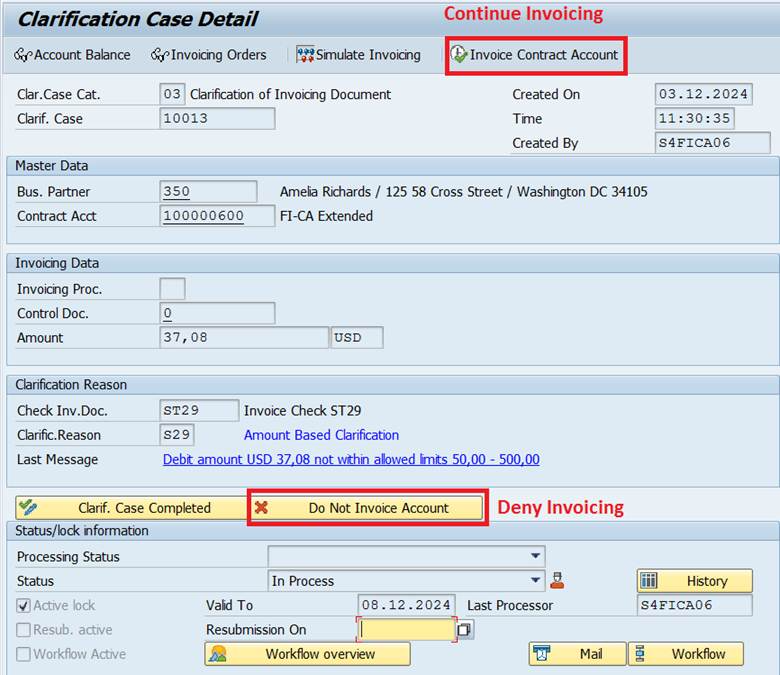

2.Clarification case (Tcode: FKKINV_CFC)

3. Invoicing denied: